Although we are still awaiting final results, with the 2024 midterm elections now largely in the rearview mirror, it is time for those thinking about running for governor in 2026 to begin formulating the ideas on which they will base their campaigns.

One area on which they will need to focus a significant amount of attention is fiscal policy: at what levels and how they propose to spend state money, and equally as important, how they propose to raise it. The latter is especially in need of reform.

Alaska is currently limping along on an increasingly self-harming three-legged revenue stool. One leg is composed of “traditional revenues,” which largely are revenues derived in various ways from the state’s petroleum resources plus some additional, relatively minor taxes and fees that, in the aggregate, bring in about $500 million – or at current levels, a little under 10% of unrestricted general fund (UGF) spending – per year.

The second is the portion of the state’s annual percent of market value (POMV) draw from the Permanent Fund that, under current law, is available to help pay for government services.

The third is an additional portion of the state’s annual POMV draw that, under current law, is to be distributed as a Permanent Fund Dividend (PFD) income to Alaska residents but which, in the absence of more equitable and lower impact revenue sources, increasingly is being withheld and diverted (taxed) by the Legislature to pay for government services instead.

Here is the outlook for each over the next 10-year planning period used by both the Office of Management and Budget (OMB) and the Legislative Finance Division (LFD) taken from our most recent set of “Goldilocks Charts” published as of the time we are writing this week’s column.

While the largest source of revenue over the period continues to be “traditional revenues,” neither those alone nor even in combination with the portion of the POMV draw that, under current law, is available to help pay for government services are sufficient at any point to cover the levels of current and projected government spending.

Instead, as the chart shows, deficits, which to date have been covered by PFD diversions, continue rising over the period at a compound annual growth rate of 3.7%, from roughly 28% of spending in FY2025 to 31% by FY2033. On a percentage basis, that’s a higher level of deficits than even the federal government’s.

Some claim that using PFD diversions to fill the gap is an acceptable fiscal policy on its own and that there’s no reason to think about alternatives.

But that’s not true. That approach is self-harming both to Alaska families and the overall Alaska economy.

As we’ve explained in previous columns, PFD cuts have the “largest adverse impact” on the overall Alaska economy and are “by far the costliest for Alaska families” of all the revenue options. They increase state poverty levels and, through that state spending, sending the PFD into a death spiral. They are the “most regressive [revenue approach] ever proposed,” and through that, are a significant contributor to the state’s net outmigration of working-age middle and lower-income Alaska families.

The only ones who benefit from the approach are those in the top 20% income bracket – from whom PFD cuts take significantly less than the alternatives – and the oil companies and non-residents, who, as a result of using PFD cuts, are able to avoid making any contribution to closing the deficits.

A revenue structure that increasingly takes disproportionately from 80% of Alaska families to shield those in the top 20%, oil companies, and non-residents is neither equitable nor sustainable. Instead, because of its adverse impact relative to available alternatives, it’s anti-economy and anti-family.

During this year’s legislative campaigns, some argued the solution was increased state resource development. But that’s just something to say during political campaigns; it’s not a real option standing alone.

For example, as we have explained elsewhere, even though oil production is projected to increase by over 35% over the next 10 years, overall UGF oil revenues are projected to decline, led by a 30% freefall in oil production tax revenues, the very source that many claim will be sufficient to cover state spending as resource development grows.

The only way that increased state resource development results in significantly increased revenues is to reform the state’s current oil tax structure, which we endorse but which, as we’ve explained in a previous column, is insufficient on its own to offset the size deficits the state is running.

During the course of these columns, we’ve identified two alternatives that we think are both good policy and explainable during a campaign.

The first is the ultra-broad based sales tax reflected in HB 142, introduced by Representative Ben Carpenter (R – Nikiski) during the last legislature. As we’ve explained in a previous column, by being dispersed among an ultra-broad base, the per-unit impact of the tax on both the overall Alaskan economy and Alaskan families is small. For those seeking some increase in oil revenues, it also produces that. By collecting a sales tax at the point of sale or transfer, the approach raises a material portion of the overall revenue from oil, much of which is exported from the state.

And while sales taxes are sometimes objectionable because of their regressive impact, again, because of the ultra-broad base, HB 142 minimizes that impact, taking less from Alaska families than either a PFD cut or our next best option, a flat tax.

During the recent campaign, Carpenter came under fire over the proposal, among other reasons, because it is designed, in part, to offset a reduction in the corporate income tax. But as we’ve explained in a previous column, that portion of the tax is severable, and the tax can easily be refocused only as a substitute for PFD cuts.

The second alternative that reflects both good policy and is explainable during a campaign is a broad-based flat tax. As we have explained in previous columns, unlike PFD cuts, which take disproportionately from middle and lower-income – working – Alaska families, a broad-based flat tax would take equally as a share of income not only from all Alaska families but, importantly, also from non-residents deriving significant income from Alaska sources (such as Hilcorp owner Jeffery Hildebrand).

Compared to the self-harm inflicted by PFD cuts, a flat tax would be neutral. If the Legislature concluded that some form of additional spending was “good for Alaska,” all Alaskans and non-residents benefitting from Alaska would contribute proportionately toward it. No one income bracket would contribute any more to the cost than any other.

Similarly, unlike under the current system, all Alaskans would have an incentive to minimize government spending. Because of the limited impact on them, under the current approach, those in the top 20% income bracket, the oil companies, and non-residents have very little incentive to push back on additional government spending. Indeed, because they don’t pay for it, they have a positive incentive to push for more that benefits them.

Replacing that system with one in which all Alaska families and non-residents bear a proportionate share of the costs would change those incentives significantly. Those in the top 20% would have the same proportionate incentive to push back on spending that now is felt only by middle and lower-income families.

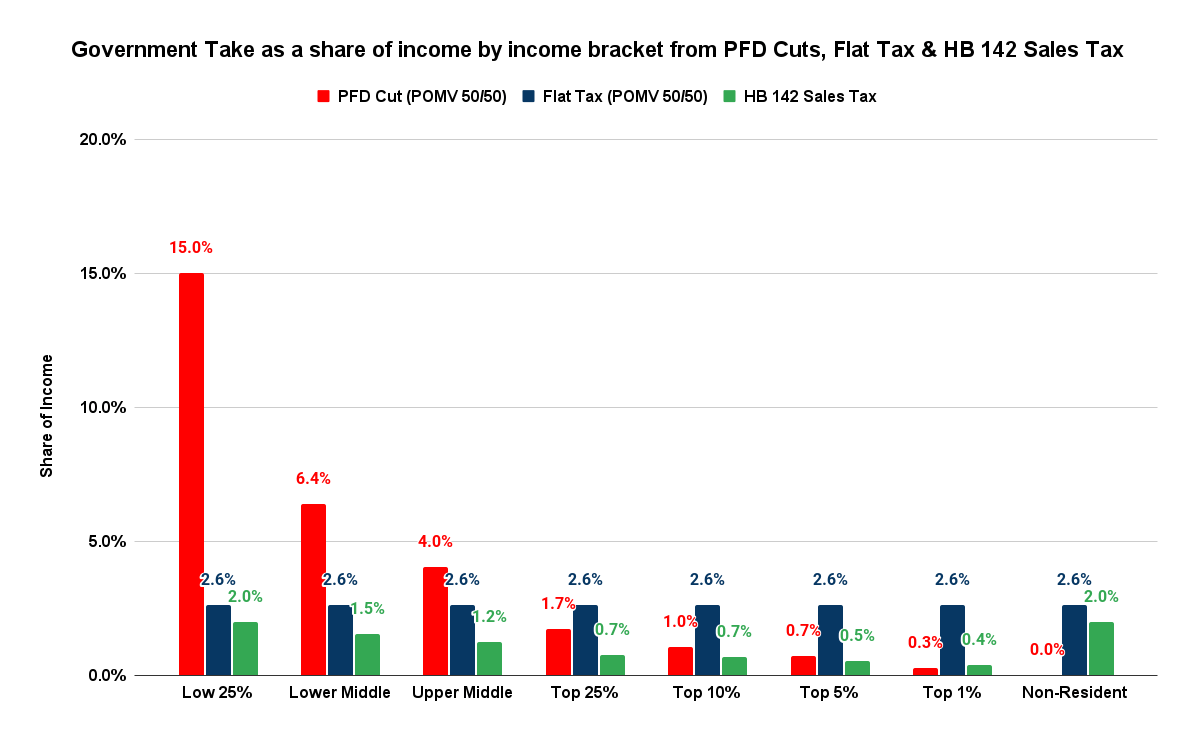

If designed as suggested by Professor Matthew Berman of the University of Alaska – Anchorage’s Institute of Social and Economic Research, a flat tax would also significantly reduce the portion of PFDs going to the federal government, an issue to some. On net, Alaska would gain much more from currently untaxed non-residents than it would lose through “leakage” to the federal government. Put another way, the Alaska economy would gain money from the approach instead, as is the case with the current approach, lose it. Here is the effect of the three approaches by income bracket. Because of its ultra-broad base, a sales tax along the lines of HB 142 would have the lowest impact on Alaskan families and, through them, the overall Alaskan economy. The flat tax would have the second lowest. Of the three alternatives, the continued use of PFD cuts has the worst impact on both.

Some oppose replacing PFD diversions with alternative revenue measures, asserting there should be “no taxes while mailing out cash.” But that position both misstates the impact of PFD cuts and ignores what is happening overall with Permanent Fund earnings.

As Professor Berman made clear in an opinion piece last year in the Anchorage Daily News, “Let’s be honest. A cut in the PFD is a tax — the most regressive tax ever proposed.” Substituting another revenue approach for PFD cuts merely replaces one form of taxation with another, more equitable, and lower-impact approach. At current and projected spending levels, there isn’t a “no tax” option.

Moreover, the argument overlooks the overall impact of how Permanent Fund earnings are used. As we have explained in a previous column, under current law, the “free money” from Permanent Fund earnings is used equally to substitute for taxes, mostly benefiting those in the top 20%, the oil companies and non-residents, and as PFDs, mostly benefitting middle and lower-income Alaska families.

At its core, all those making the argument are pushing is to increase the portion of the “free money” used to benefit those in the top 20%, the oil companies and non-residents. They aren’t opposed to “free money” or “mailing out cash”; they just want more and more of it used for their benefit.

Others propose making deep cuts in the PFD and diverting it instead to major projects, such as an Alaska gas pipeline, to the “benefit of the state and its citizens.” It may be that major projects would be of significant benefit to the state. But if that’s the case, then all Alaskans, as well as the oil companies and non-residents who would share in the benefits, should share proportionately also in the costs. There is no good argument as to why the burden should be borne most heavily by middle and lower-income Alaskan families, while those in the top 20% income bracket, the oil companies, and non-residents who would benefit significantly largely escape.

As the net outmigration numbers are already showing, Alaska can’t continue to place more and more of the financial burden of the state government on the backs of middle and lower-income Alaskan families without significant negative consequences.

We anticipate there will be a number of candidates in the coming election cycle who will want to lead Alaska in doing “big” things. Alaskans should pay close attention to how – and through that, who – they propose pay for them.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Well Said – My Concern, Will Any Of These Running In 2026, Listen…. And, Will The Voters!

Math:

734,000 Alaskans

20% of Alaskans = 147,000 Alaskans

Current PFD giveaway = $1,000,000,000 per year

To pay for that giveaway (not the larger “statutory” model demanded by so many), you must take $6800 from each and every one of those “rich 20%ers”.

Not joint taxpayers, or heads of households. Individuals.

Give us details now. What taxes are you going to install that the 80% won’t pay?

Where have you been since 1913 when our federal income tax was justified and initiated with your exact argument?……..but without Uncle Sam handing out cash to everybody……..

Looking at the second chart in the column, based on the most recent IRS data (which is published in quartiles), at POMV 50/50 the Top 25% are underpaying the average (flat) tax by roughly 0.9% (or about $92 million). Put another way, they are receiving an income subsidy of $92 million by shifting an excess burden of the same amount to everyone else. Rebalancing that to eliminate the subsidy and equalize the burden across all income groups would amount to about $1,347 (or, again, less than 1% of average income) per Top 25% household.

Now you are adding $1347 in federal taxes to the $6800 state tax burden you are demanding, not explaining how you’re going to get the $6800 from them statewide while not burdening the other 80%, now and in the future. Some of us have also seen you defending your tax advocacy in other online publications from state leaders who openly oppose your position. You called them “misleading”. Methinks you are the misleading one. Your battle is with the Legislature, who have rejected increased or new taxes (both individual and oil production) for the past three governor administrations in favor of… Read more »

I can’t tell if you really don’t understand any of the actual numbers or are just playing like you don’t in an attempt to confuse the few readers who read your replies (the old Michael Chambers shtick). The $1,347 in state payments is to equalize the state tax burden across all state income brackets. It is the actual number that replaces the “$6800” you “derived” almost entirely out of thin air. The actual number is calculated from the real adjusted gross income numbers by income bracket. The common data source for that (used by the Census Bureau and others) is… Read more »

It’s not a matter of understanding your colorful charts. It’s a matter of rejecting them. It’s propaganda, and unremarkable propaganda at that. Currently, NOBODY in Alaska is paying individual state income or sales tax, unless you want to discuss the oppressive $0.08 state fuel tax, among the lowest in the nation. The $6800 I derived wasn’t out of thin air, unless you are willing to admit that your repeated derision of the “top 20%” is truly the hot air that I’m pointing out. The $6800 is, again, what each and every individual among your hated rich will have to pay… Read more »

I didn’t deprive $6800 out of thin air. I calculated it out of validated state population census numbers divided by your hated 20%, and divided the taxable burden you demand among this “rich folks” just to pay the current PFD, which is roughly half of the “statutory” amount so many are demanding. Mail out double the PFD? Double the $6800 tax burden on the 20%. You think that’s going to fly? The Legislature and three governors now have slammed your tax demands both in session and in the media. You can continue with your socialist dream, but like Marx, you’ll… Read more »

A flat tax recovers the deficit (the $1 billion in your calculation) proportionately as a share of income broadly from all Alaska families and non-residents. That’s not Marx; that’s straight out of Adam Smith’s (the father of capitalism) book The Wealth of Nations, Book V, Chapter 2, Part 2, the first of the “four maxims of taxation.” An ultra-broad sales tax recovers the deficit (again, the $1 billion in your calculation) proportionately as a share of virtually all sales of goods and services made in the state (roughly $50 billion annually). In doing so, a significant share of the revenue… Read more »

So you’re finally willing to agree than none of your tax schemes can recover a billion dollars out of the top 20%? How many exchanges did it take for you to finally admit the obvious? Can you please now admit that this is why the past few Legislatures and governors have steadfastly refused to increase the PFD to the widely demanded “statutory” amount? Are you finally willing to admit that your entire schtick is the preservation of the PFD as the nation’s first Universal Basic Income program? Are you going to claim that this transfer patently is recognized as Adam… Read more »