While others have focused on other parts of Governor Mike Dunleavy’s (R – Alaska) recent press release announcing his line-item vetoes from the Fiscal Year (FY) 2024 budget, this is the sentence that caught our attention:

“This budget is a responsible path for Alaska’s financial future,” said Governor Dunleavy.

As signed by Dunleavy, “this budget” is based on a revenue approach that splits the annual percent of market value (POMV) draw from Permanent Fund earnings 25 percent to the Permanent Fund Dividend (PFD) and 75 percent to the “Tax Avoidance Dividend” we discussed in last week’s column (“The actual ‘mega-dividends’”).

As we explained there, the Tax Avoidance Dividend essentially is an indemnity – a shield – from paying taxes for the costs of state government. By diverting Permanent Fund earnings to pay for government, it allows those who otherwise would pay taxes to keep the money in their bank accounts instead. Doing so is as much of a benefit as receiving the cash.

As we explained in the column, the use of Permanent Fund earnings to avoid taxes is of most value by far to upper-income Alaskans, i.e., those in the top 20% income bracket. The PFD is increasingly of minor, almost trivial economic significance to those in the top 20%.

Conversely, the PFD is of the most value by far to middle and lower-income Alaska families. The value of the Tax Avoidance Dividend is increasingly less.

Using the most recent projections from the Permanent Fund Corporation (May 2023) and the current outlook for FY24 oil prices, the use of POMV 25/75 in the FY24 budget represents a single-year shift of approximately $1.3 billion from the levels reflected in current law and incorporated in the Governor’s proposed FY24 budget for the PFD to the Tax Avoidance Dividend – in other words, from the use of most importance to middle and lower-income Alaska families to the use of most importance to those in the top 20%.

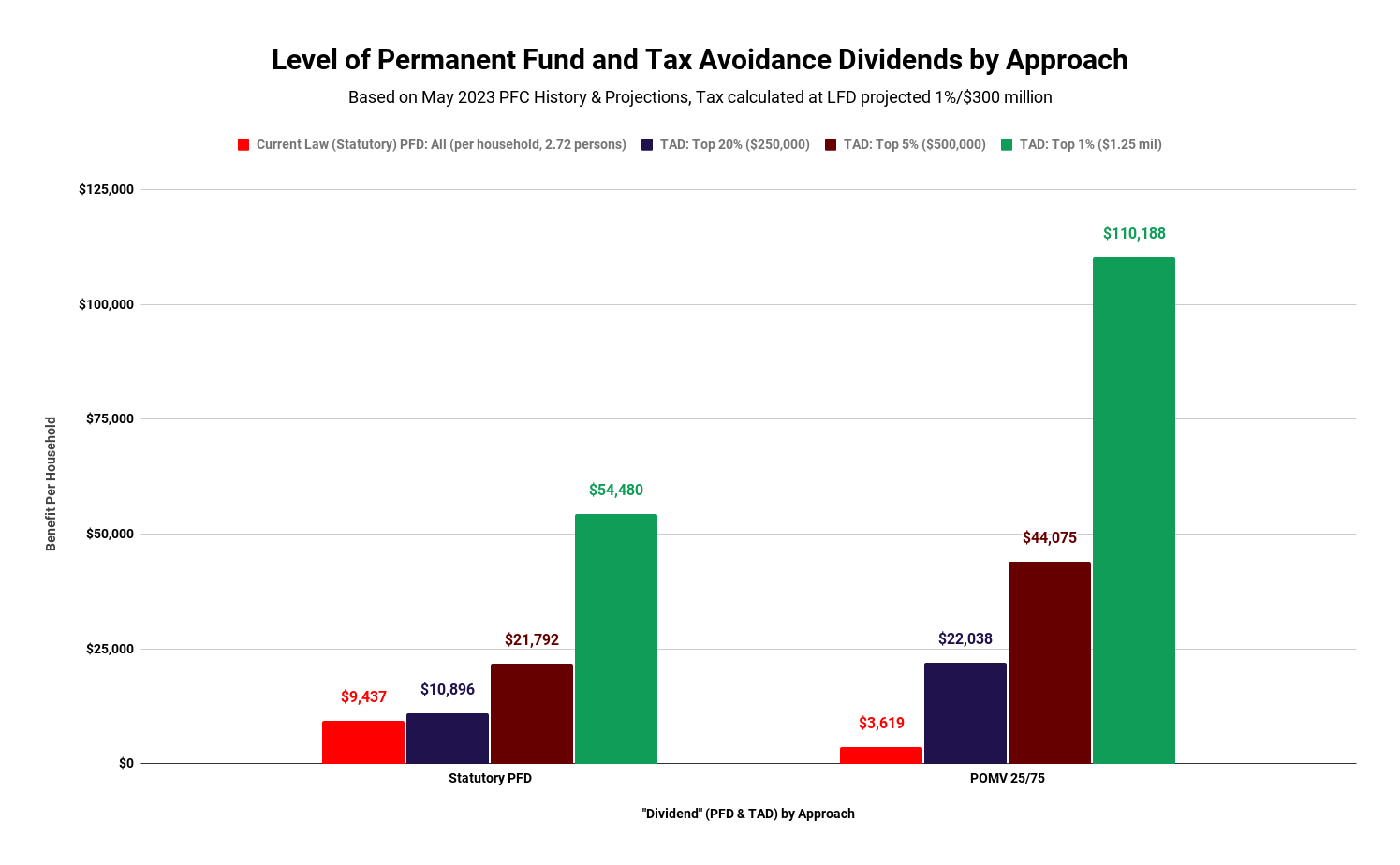

Using the distributional approach we used in last week’s column to analyze the effects, the impact on Alaska families of the change in the PFD and Tax Avoidance Dividend for FY24 alone is this:

While the PFD for the average Alaska household (in red) drops by nearly $6,000 (from $9,437 to $3,619), the Tax Avoidance Dividend for the average household in the top 20% (blue) increases by roughly $11,000, for those in the top 5% (maroon) by over $22,000, and for those in the top 1% (green) by over $55,000.

In other words, while the portion of Permanent Fund earnings used in the way of most importance to middle and lower-income Alaska households goes backward, the portion of most benefit to those in the top 20% substantially increases.

It’s a massive win for the top 20% – particularly those in the top 5% and top 1% – at the expense of middle and lower-income Alaska families.

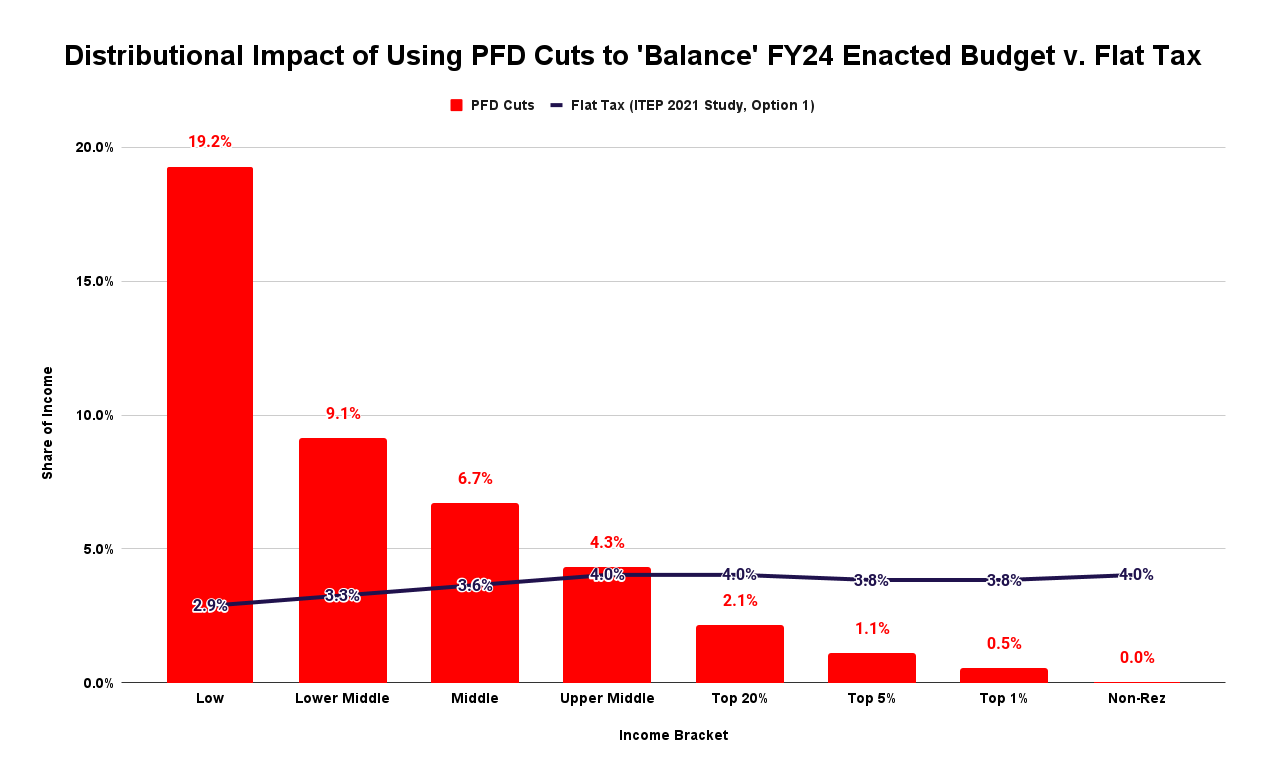

Looked at by income bracket, the impact is this:

Reflecting the level of the PFD cuts, middle and lower-income Alaska families contribute substantially more as a share of their income to the costs of government than do those in the top 20% and non-residents.

Overall, Alaskans contribute roughly 4% of overall adjusted gross income (AGI) to cover the costs of government. Compared to that average rate of roughly 4%, middle and lower-income Alaska families contribute between 19.2% (lowest 20%) and 4.3% (upper middle) of their income to cover the costs of government.

On the other hand, instead of contributing at the average rate of roughly 4%, after accounting for the Tax Avoidance Dividend, the average household in the top 20% contributes only 2.1%, the top 5% only 1.1%, and the top 1% only 0.5% of their income to the costs of government.

Non-residents engaged in economic activity in Alaska contribute zero.

The result is hugely regressive. As a measure, those in the lowest 20% contribute 38 times more than those in the top 1%.

But as problematic as the FY24 result is, it pales by comparison if, as Dunleavy’s press release implies, that approach is viewed going forward as “a responsible path for Alaska’s financial future.”

As we explained last week, the long-term impact of moving from a current law (statutory) to a POMV 50/50, POMV 25/75, or “leftover” PFD has a significant adverse impact on middle and lower-income Alaska families.

In the aggregate, permanently moving from a current law (statutory) PFD to a POMV 25/75 PFD will reduce the income of the average Alaska household by nearly $65,000 over the nine-year period from FY24 to FY32. On the other hand, by shielding them from taxes, it will increase the net wealth of the average top 20% household by nearly $125,000, the top 5% household by nearly $250,000, and the top 1% household by over $600,000 over the same period.

Here’s the aggregate impact over the period:

Instead of receiving a projected aggregate of $97,248 in PFDs (in red) over the period, the average Alaska household will only receive $32,568, 67% less.

On the other hand, instead of receiving the benefit of $98,321 in Tax Avoidance Dividends over the period, the average top 20% household (in blue) will receive $222,171, 125% more. Instead of receiving the benefit of a projected average of $196,642 in Tax Avoidance Dividends over the period, the average top 5% household (in maroon) will receive an estimated $444,342. And instead of receiving the benefit of a projected $491,604 in Tax Avoidance Dividends over the period, the average top 1% household (in green) will receive an estimated $1.1 million.

In short, as we explained in last week’s column, over the period, middle and lower-income Alaska families will become materially poorer, while the top 20% will become increasingly rich as a direct result of the shift of the PFD from the current law (statutory) approach to POMV 25/75.

What concerns us about Dunleavy’s statement is that it appears to signal a change from the direction in which he was headed as recently as the end of April this year.

In a press conference then, Dunleavy said in talking about the state’s fiscal approach, “[a] broad-based solution that doesn’t gouge or take huge parts from one sector or another, or penalize one sector or another, is probably the most important thing we can do.”

Specifically, he mentioned that he would shortly be introducing a sales tax as a substitute for PFD cuts and calling a special session to resolve the state’s fiscal future if the Legislature was not able to do so in the regular session.

While still somewhat regressive, substituting a sales tax would significantly reduce the much greater regressive impact on middle and lower-income Alaska families resulting from using PFD cuts.

Subsequently, however, he has never introduced a sales tax, and his veto message makes no mention of either the sales tax or a special session. Instead, asserting they are “unnecessary,” Dunleavy has vetoed the very funds set aside in the budget for the special session.

We’ve seen this behavior before. At the start of the 2021 session, for example, Dunleavy said he would introduce a bill to legalize gaming in Alaska as a means of raising state revenue. Then later in the year, as part of hearings before the Legislature’s Fiscal Policy Working Group, Lucinda Mahoney, his then-Commissioner of Revenue, said that the governor could support a variety of revenue measures, including a change in oil taxes, as potential parts of a long-term solution.

None of those, however, were ever introduced, as he received significant pushback from opponents, first on the gaming bill and then on oil taxes.

We are concerned the same behavior is repeating this time. Early in this session, the Alaska Policy Forum, led by Board Chair Jody Taylor, the wife of Attorney General Treg Taylor, and Executive Director Bethany Marcum, a former aide to Dunleavy when he served in the Legislature and more recently, one of his appointees to the Alaska Redistricting Board, staked out its opposition to both a sales tax and an income tax.

Then, since his April press conference, Americans for Prosperity-Alaska has gone on an advocacy and advertising spree also opposing both sales and income taxes.

Both groups have based their positions on the adverse impact of those approaches on Alaskan income.

Tellingly, however, neither has compared the relative impact of the approaches they oppose to the alternative of continued, deep PFD cuts as reflected in the FY24 budget. As both the 2016 and 2017 studies by researchers at the University of Alaska-Anchorage’s Institute of Social and Economic Research (ISER) and a 2017 study by the Institute for Taxation and Economic Policy (ITEP) make clear, PFD cuts have a far worse impact on middle and lower-income (80% of) Alaska families than either of the tax approaches.

The real concern of both organizations, then, seems to focus entirely on the impact of the alternative approaches on the top 20%. By omission, both have made clear they are willing to sacrifice PFD cuts – the approach with the largest adverse impact on middle and lower-income Alaska families – as long as sales and income taxes – those with the largest adverse impact on the top 20% – are stopped. We are concerned that the governor’s silence since the April press conference on sales taxes and the need for a special session to address alternative revenue measures, along with, most recently, his statement that the FY24 budget “is a responsible path for Alaska’s financial future” signals that, like his previous capitulation to the gaming and oil industries, he is now doing the same in response to pushback from the top 20%.

Maybe time will prove us wrong, but the statement Dunleavy included in the press release announcing the FY24 vetoes seems to indicate otherwise.

Instead, to quote the old Peggy Lee song, it appears he is fine with Alaska’s rich getting richer while the other 80% of Alaska families grow increasingly poor.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Thank you Brad

Always read and appreciate your take.

Agree that I’m getting the short end of the stick as are the 80%. These people just done care just like voting in this city. Either lazy or on the government tit.