In last week’s column we updated the 10-year outlook for Alaska’s fiscal situation for current oil futures, the Permanent Fund Corporation’s most recent projections for percent of market value (POMV) draws and the statutory Permanent Fund Dividend (PFD, calculable from their projection of Statutory Net Income), and projected Unrestricted General Fund (UGF) spending levels, based on the Dunleavy administration’s most recent (December 2021) 10-year plan, updated for the results of the 2022 legislative session and current inflation expectations.

As we put it there, “[t]he plain meaning of the update is clear – after a (very) brief respite, the Alaska budget is on course to fall back into deficit sooner [and we would add, deeper] than projected in the Spring 2022 Revenue Forecast.”

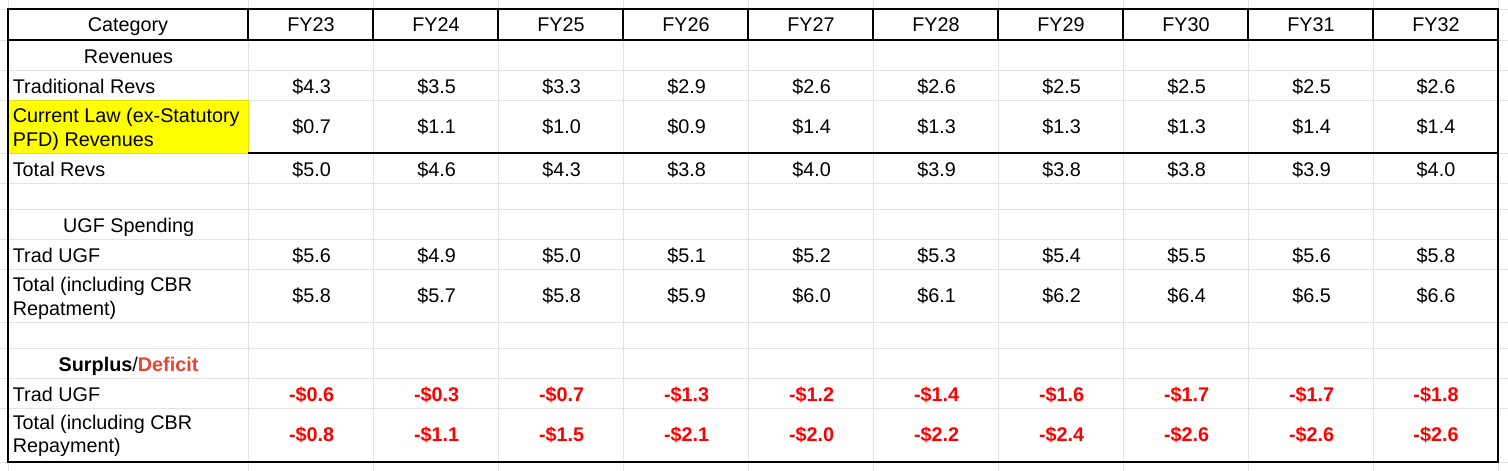

To summarize, here is the outlook under current law:

Deepening current law deficits throughout the entire period.

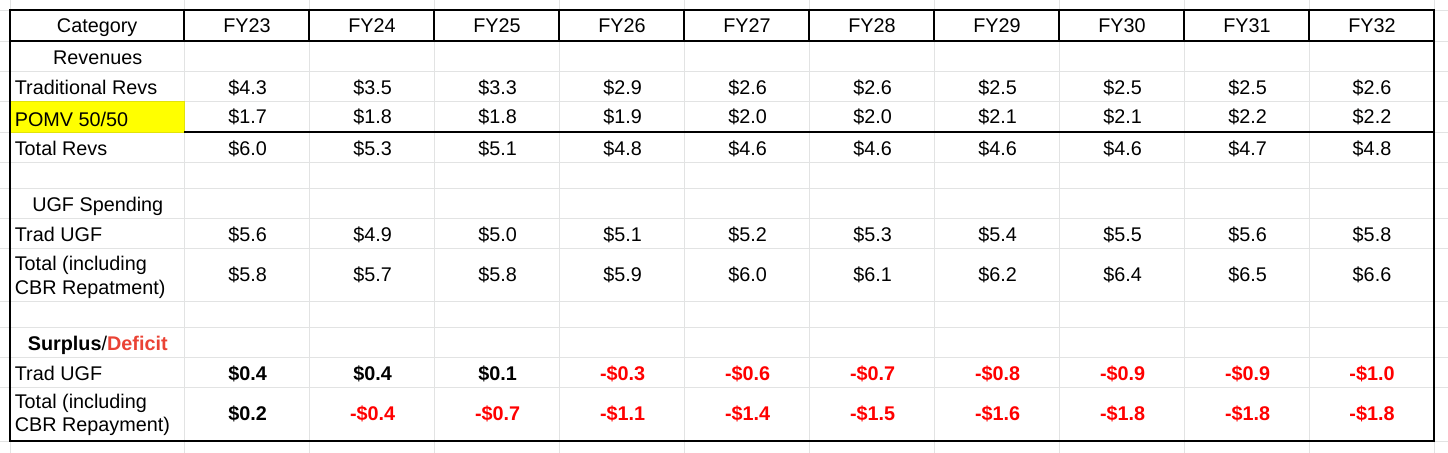

And here is the outlook using Governor Mike Dunleavy’s (R- Alaska) proposed POMV 50/50 approach.

While the POMV 50/50 approach delays and softens the deficits, they nevertheless still begin during the term of the governor elected this year and deepen thereafter.

As a result, a critical question to ask this election cycle is what each candidate’s plan is for dealing with Alaska’s fiscal challenge going forward – and a critical step in our evaluation process, at least, is to assess the credibility and impact of their response.

The Fiscal Plans

Based on our review of their campaign websites and other materials, here are the proposed fiscal plans of the three major candidates: Governor Dunleavy, former Representative Les Gara (D) and former Governor Bill Walker (I).

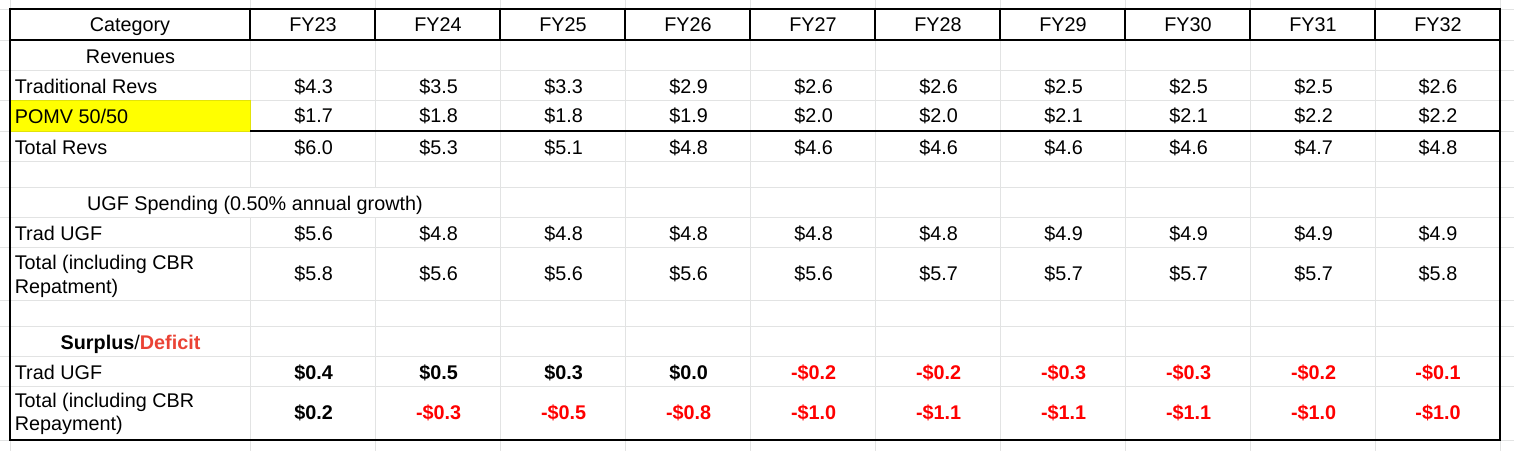

While not comprehensively written anywhere that we have been able to find – the campaign’s website, for example, only contains brief mentions of some of the components – based on his past actions and recent statements Governor Dunleavy’s plan appears to be threefold: (1) the adoption of POMV 50/50 (which over the 10 year period permanently diverts about $800 million per year from the statutory PFD to UGF revenues), (2) heavily restrained spending (the administration’s most recent 10-year plan (from December 2021) appears to contemplate holding the overall Operating Budget to growth of roughly 0.5% per year, including inflation, and the Capital Budget flat), and (3) growth in oil (and to a very slight extent, other mineral) revenues from increased production.

While not gathered under one heading, Gara’s plan nevertheless is more transparent: increased spending across a range of areas (e.g., K-12, construction) and a “strong” PFD, both funded by increased oil tax revenues (resulting from the elimination of the so-called oil and gas tax “credits”).

Former Governor Walker’s plan also is more transparent: like Gara’s, increased spending also in a range of areas (also K-12, construction, the University), but unlike Gara’s funded largely through PFD cuts (so that “100% of our government services [are] funded from Permanent Fund earnings”).

Our Assessment: Two from Fantasyland, One borrowed from Leona Helmsley

Viewed in the context of recent history, neither Governor Dunleavy’s nor Gara’s plans are realistic.

After rebasing spending for the results of this year’s legislative session as we did in our July Updated 10-year Outlook, even if Governor Dunleavy thereafter holds spending to the 0.5% per year average growth projected in his administration’s most recent 10-year plan and permanently cuts the PFD to POMV 50/50 the budget still crosses into deficits before the end of the next 4-year term.

And even that result is overly optimistic. It is unrealistic to think that, if re-elected, he will be able to restrain annual spending growth to 0.5% even over the next four years.

While the UGF budget was reduced slightly during the first two years of his term – by $50 million (FY20 over FY19) and an additional $120 million (FY21 over FY20) – it has exploded since. Including the supplemental, FY22 spending was up $900 million over FY21 and, even excluding forward funding of K-12, enacted FY23 is up another $630 million over FY22.

Against a backdrop of projected average inflation rates of 2.51% over the next five years, and 2.33% for the five years beyond that, it is unrealistic to think that overall spending growth can be held even to half, much less as a 0.5% growth rate would imply, to a fifth of those levels.

Also, the budget won’t be bailed out, as some claim, by increased production.

Even to get where it is, Dunleavy’s budget already relies heavily on production growth through the 10-year period. The latest Spring Revenue Forecast already projects production growth from 502 thousand barrels per day (Mbd) this year (FY23), to 514 Mbd in the last year of the term of the governor elected this year (FY27), to 577 Mbd by the last year of the forecast period (FY31). As we explained in a previous column, it is unrealistic to project on top of that the additional growth required to balance the budget through production.

In short, Governor Dunleavy is running on a fiscal plan produced in Fantasyland.

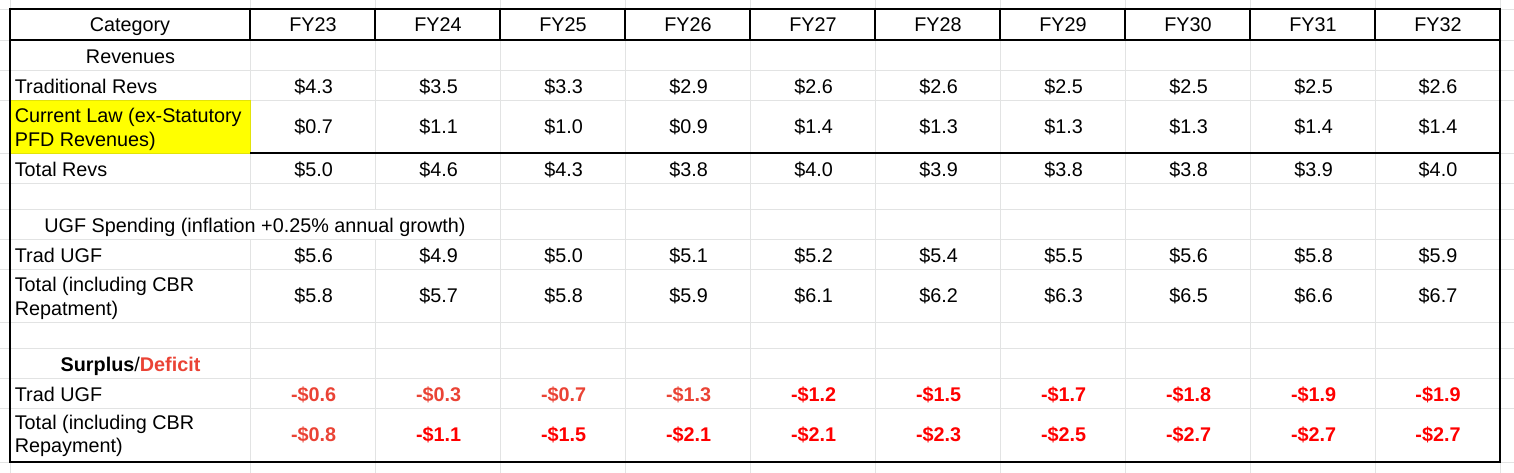

But he isn’t the only one. Gara’s plan is equally as unrealistic, albeit for a different reason. Although he does not quantify the amounts, he is clear in proposing increased UGF spending levels above those included in the current administration’s most recent 10-year plan. And he proposes a “strong” PFD, although again without quantifying the amount.

Combined with using the statutory formula to determine the PFD (our proxy for a “strong” PFD), even adding only 0.25% annual growth on top of inflation to our July Updated 10-Year Outlook produces significant additional deficits.

Unlike Governor Dunleavy, Gara at least proposes additional revenues to offset the resulting deficits. But realistically, the source of those revenues – increased oil taxes – is equally as suspect as Governor Dunleavy’s anticipated spending constraint and additional production.

As we explained in a previous column, balancing the budget through increased oil taxes would require significant increases in government take from oil. Those aren’t realistic.

As we explained in that column, “just two years ago Alaska voters overwhelmingly rejected Ballot Measure 1 – a proposal to increase oil taxes on certain producers and fields on the North Slope by what the proponents estimated to be about $1 billion – by a margin of roughly 16% (58% to 42%). [And] the past two sessions the Legislature hasn’t come close even to addressing what some refer to as the Hilcorp loophole, an obvious and easily fixable glitch through which the Department of Revenue (DOR) recently estimated Hilcorp avoids paying on average roughly $90 million/year in corporate taxes that previously were paid by its predecessor.”

While “raising oil taxes” may resonate well with supporters on the campaign trail, we should anticipate that, when the rubber subsequently meets the road in a legislative session, the potential will quickly evaporate for the same reasons as caused Ballot Measure 1 to fail so dramatically and have led the Legislature continually to look the other way in fixing the Hilcorp loophole.

While, as we explained in another previous column, we believe the state is leaving some money on the table in its dealings with the oil companies, until either an administration or the Legislature does the hard work necessary to convincingly demonstrate to Alaska voters how much, we doubt the results will be any different than in previous efforts. And even if successful then, we doubt the resulting increases will be anywhere close to those assumed by the Gara campaign in its proposed fiscal plan.

In short, Gara’s fiscal plan also is a product of Fantasyland.

Unlike Governor Dunleavy’s and former Gara’s, we don’t dismiss former Governor Walker’s plan as unrealistic. Continuing the approach he used during his term as governor, Walker proposes to use PFD cuts to fund both current and future deficits. As we explained in a previous column, raising revenue from Alaska families in that way provides a substantial cushion against future deficits, more so than perhaps any other approach.

But it is a plan taken straight from the playbook of the so-called “Queen of Mean,” Leona Helmsley, the wealthy business woman who, during her 1989 trial for income tax evasion, was reported to have once said about herself and her husband: “We don’t pay taxes. Only the little people pay taxes.”

Walker’s plan is basically the Alaska version of that approach. As we explained in an earlier column, “The Yuppie version of fiscal responsibility,” by using PFD cuts to fund government, Alaska’s top 20% are able to dodge contributing significantly both now and in the future. Instead, the costs of government continually are taken largely out of the pockets of Alaska’s “little people,” Alaska’s middle and lower income families.

While that approach is popular with Walker and his top 20% donors, like Keep Alaska Competitive’s Jim Jansen, former Senator Cathy Giessel, and the other co-chairs of his campaign, it shouldn’t be with anyone outside of Alaska’s plutocratic “charmed circle.”

As researches from the University of Alaska – Anchorage’s Institute of Social and Economic Research concluded in their 2016 report to the then-Walker Administration, of the various options using PFD cuts to fund government has the “largest adverse impact” on the overall economy and on 80% of Alaska families.

A Missed Opportunity

We anticipate some having read this far are saying, “but what do you expect them to do; they can’t talk about … taxes 😱😱.”

The thing that really surprises us this campaign cycle is that, while they have the perfect political cover to do exactly that, they still haven’t.

What provides the “perfect political cover?” The recommendations of the Legislature’s 2021 bi-cameral and bi-partisan “Fiscal Policy Working Group.” As we explained in a previous column, those recommendations both face the reality of Alaska’s fiscal condition head on and propose a comprehensive, all-of-the-above solution that spreads the burden of solving them broadly, with oil companies, non-residents and all Alaska families all taking a share.

Moreover, the recommendations were offered unanimously from a politically broad spectrum. The Working Group included both some of the most conservative, as well as some of the most progressive members of the current Legislature.

Any – indeed, all – of the candidates easily could have endorsed the recommendations of the Working Group and made their balanced and pragmatic solutions a centerpiece of their campaign.

To us, the fact that none of them have says a lot about their collective failure to deal with Alaska’s current fiscal situation honestly, in a balanced, equitable and economically low impact manner.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a project focused on developing and advocating for economically robust and durable state fiscal policies. You can follow the work of the project on its website, at @AK4SB on Twitter, on its Facebook page or by subscribing to its weekly podcast on Substack.

Tax the poor to feed the rich! Great thinking, Walker! Thanks Landmine for this series of articles.